salt tax deduction repeal

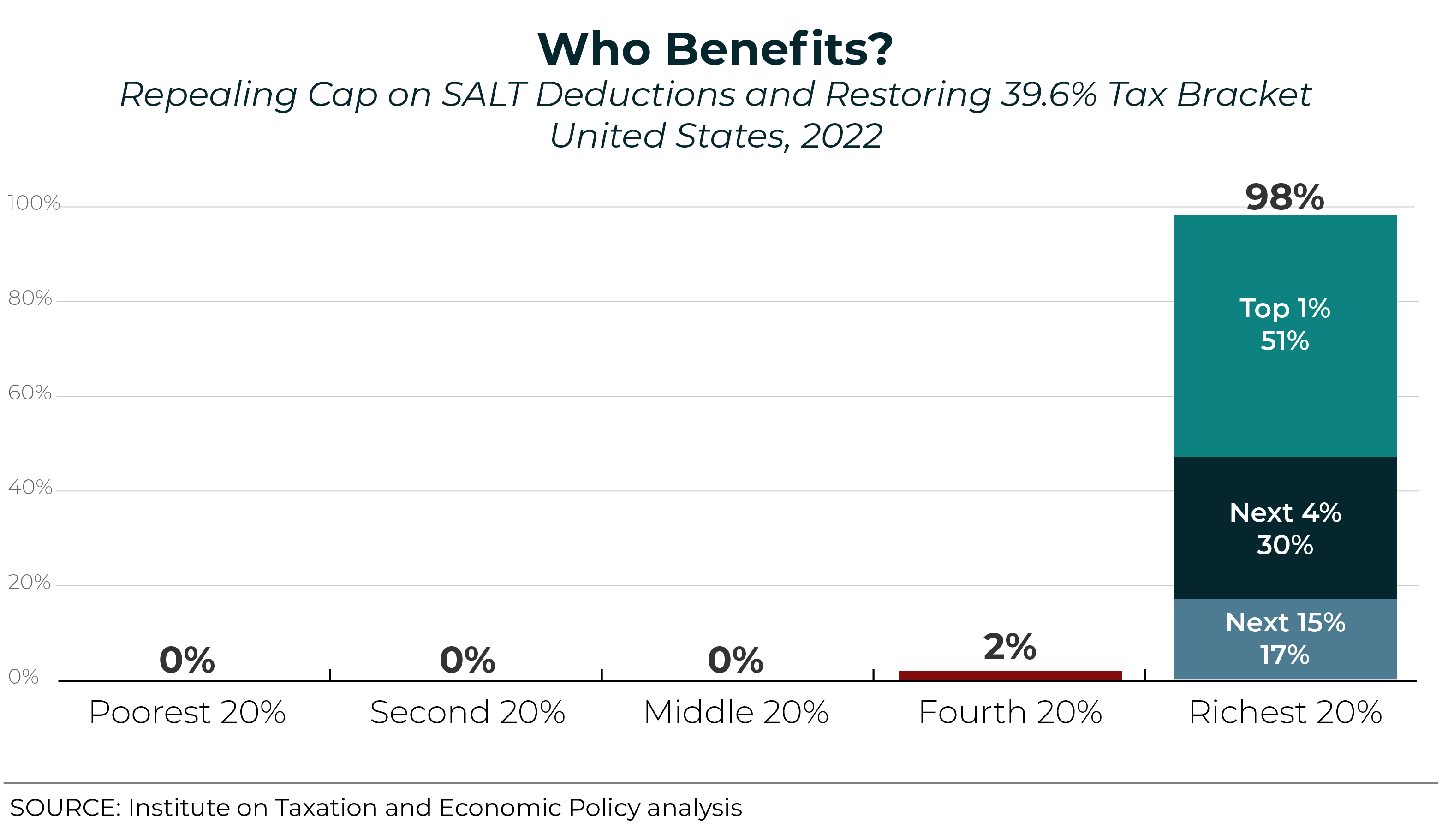

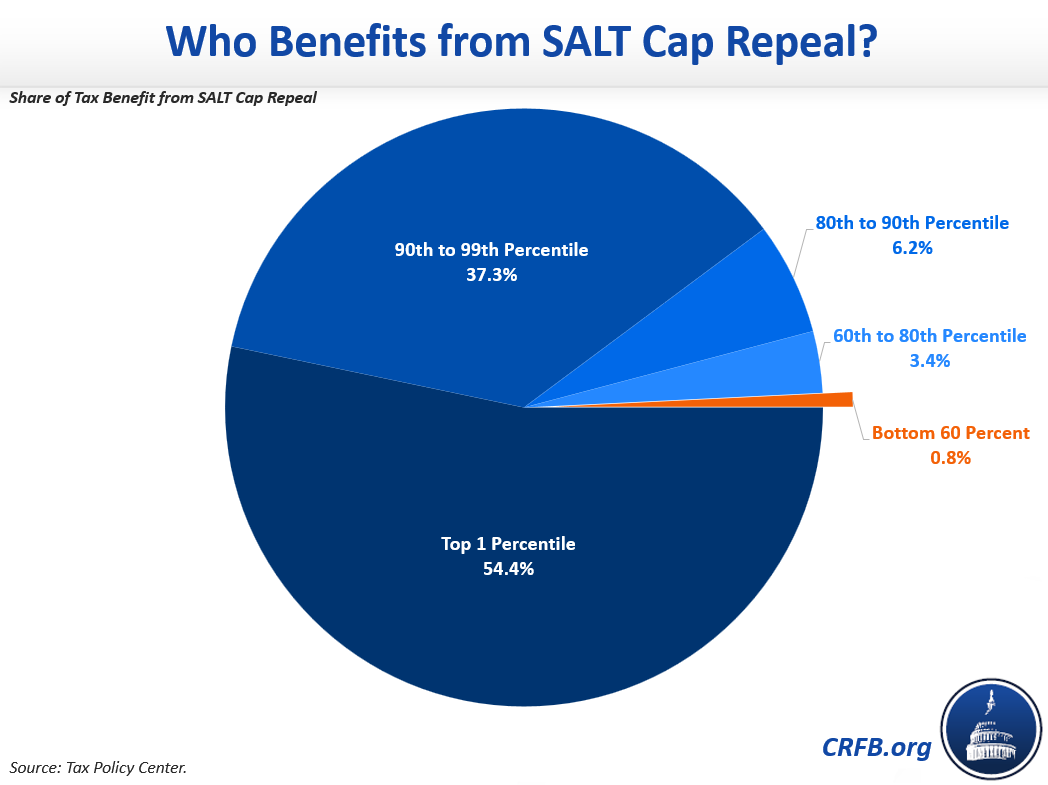

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot.

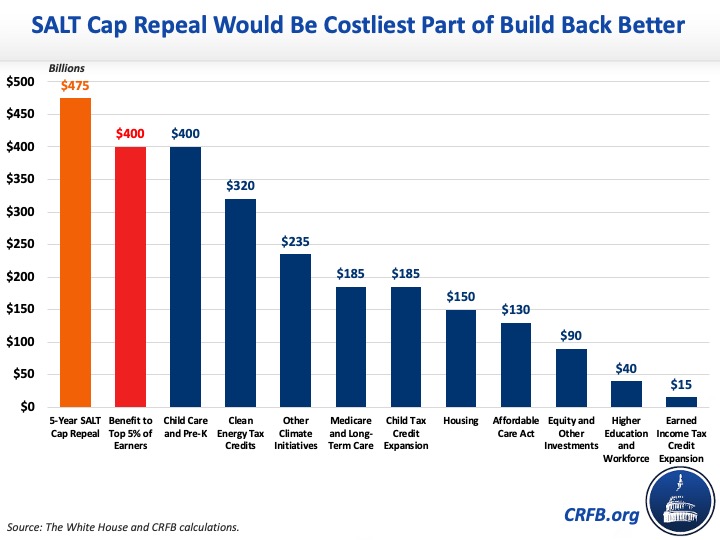

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Lawmakers are currently considering possible changes to the state and local tax SALT deduction.

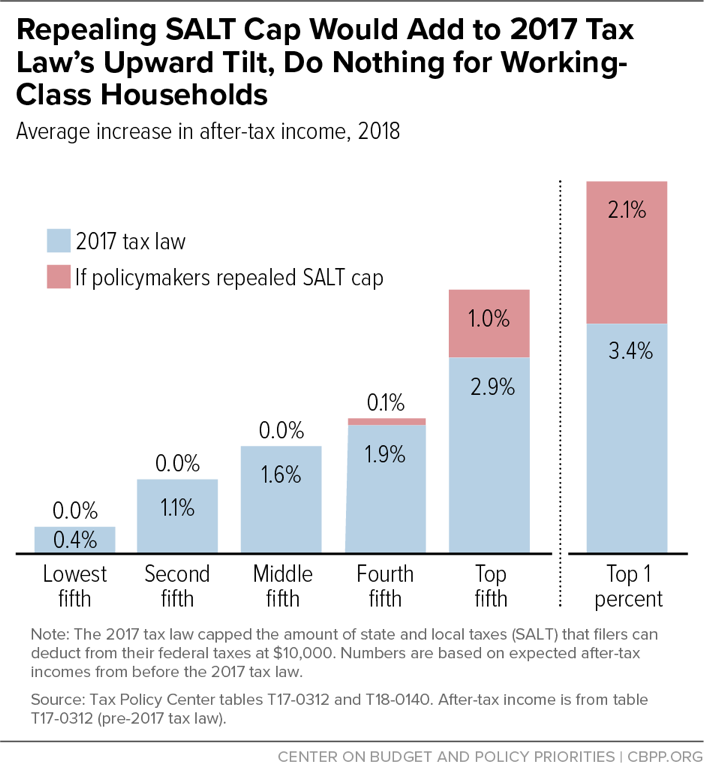

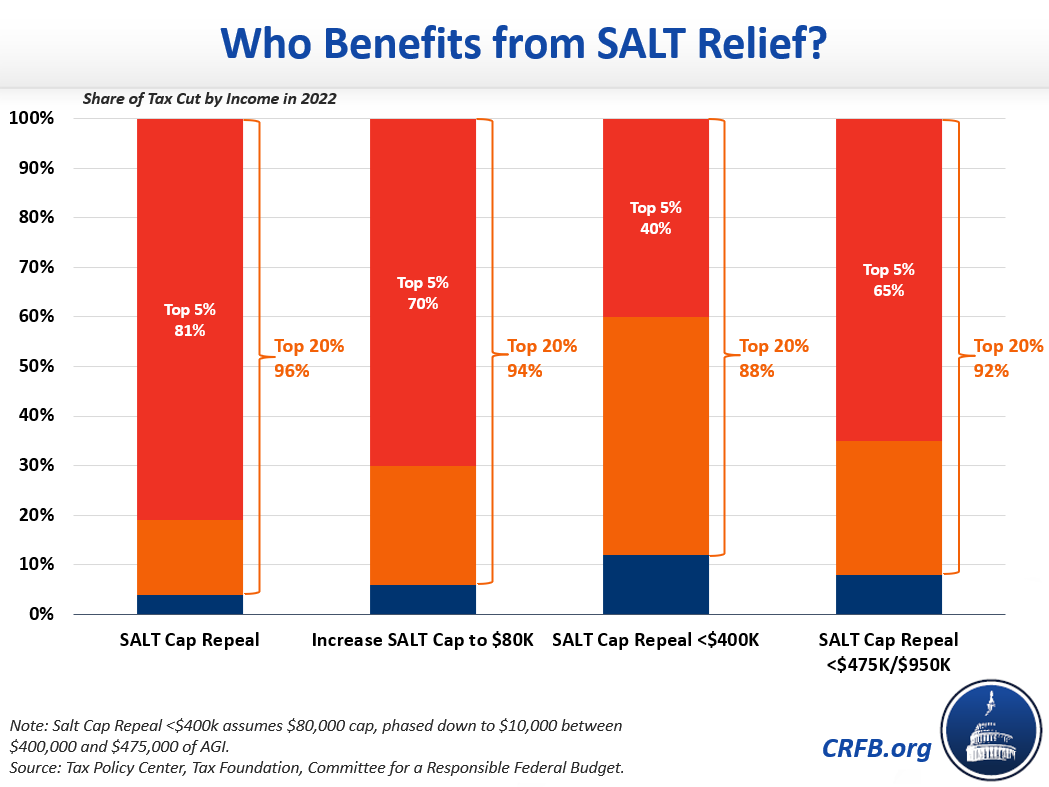

. The House-passed Build Back Better Act for example would raise the cap. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent.

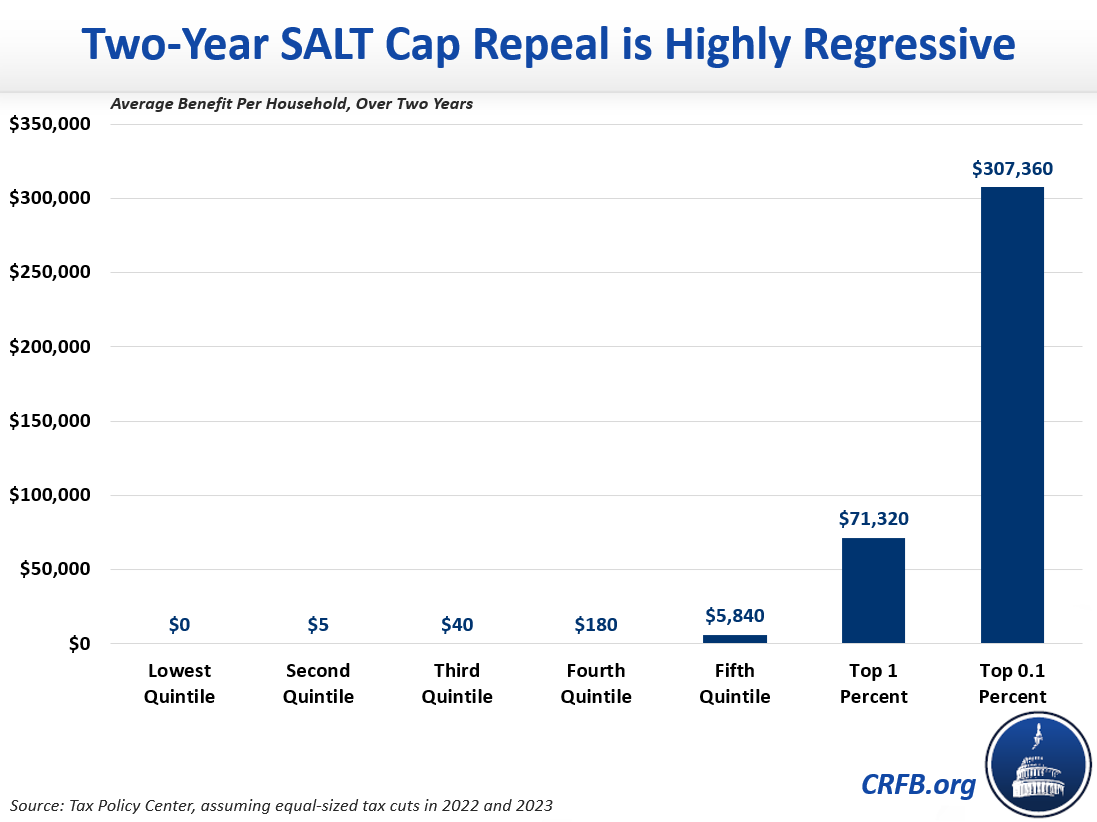

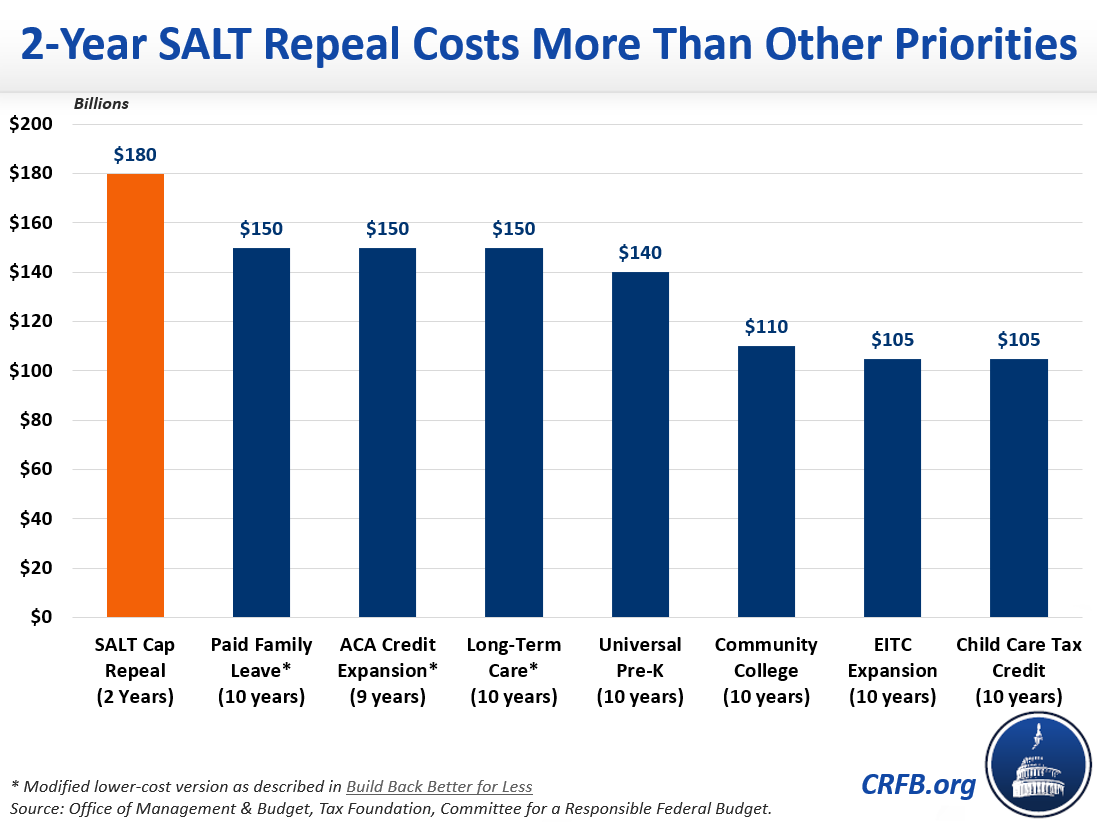

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Doubling the cap to 20000 would remove. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

Second the 2017 law capped the SALT deduction at 10000 5000 if. The 10000 cap on our State and Local Tax deduction has. But you must itemize in order to deduct state and local taxes on your federal income tax return.

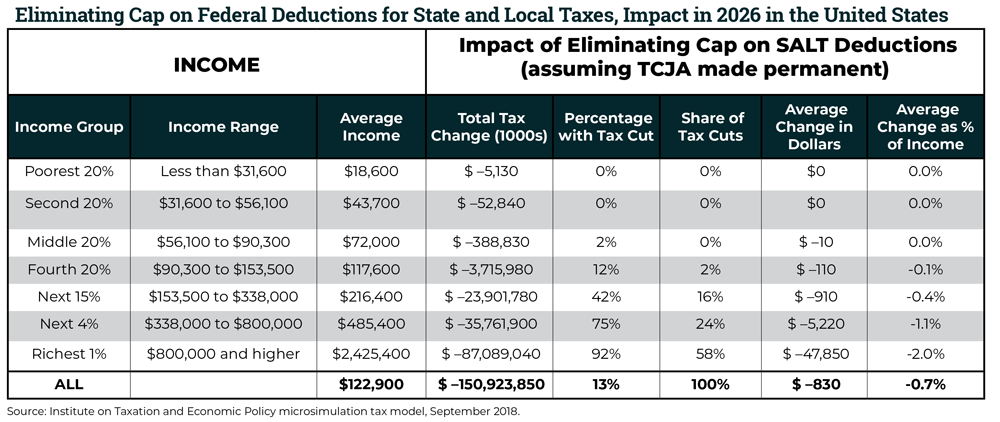

Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken. One way to offset that cost would be to eliminate the state and local tax SALT deduction which is capped at 10000 through 2025 and tends to benefit higher-earning. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. As alternatives to a full repeal of the cap lawmakers and. Not in these quarters.

The 2017 Tax Hike Bill may have lowered taxes in other parts of the country but in Northern New Jersey the average tax bill went up. The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. The state and local tax deduction cap set to expire at the end of 2025 limits the amount of state and local taxes that taxpayers can deduct from their federal taxes to 10000.

Schumer and Congressman Tom Suozzi D-Long Island Queens joined together with local families to unveil a plan to fully repeal the. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

At least hes trying. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the. Discover Helpful Information And Resources On Taxes From AARP.

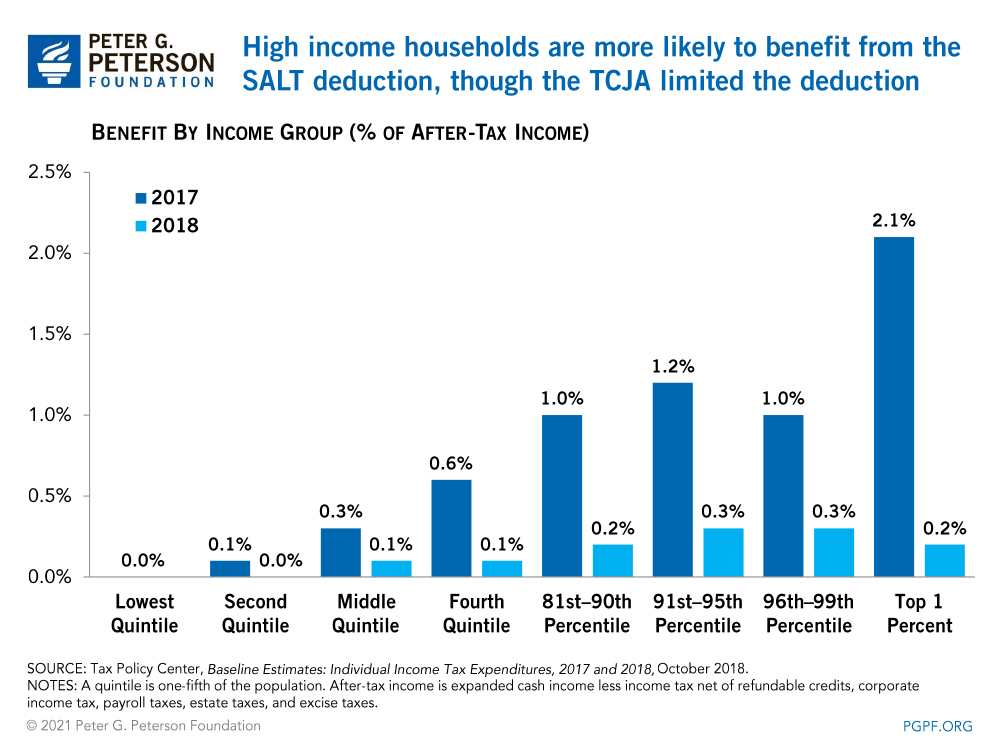

The SALT deduction benefits only a shrinking minority of taxpayers. Tax Policy Center. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the.

Today Senate Minority Leader Charles E. The deduction cap should be fully.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

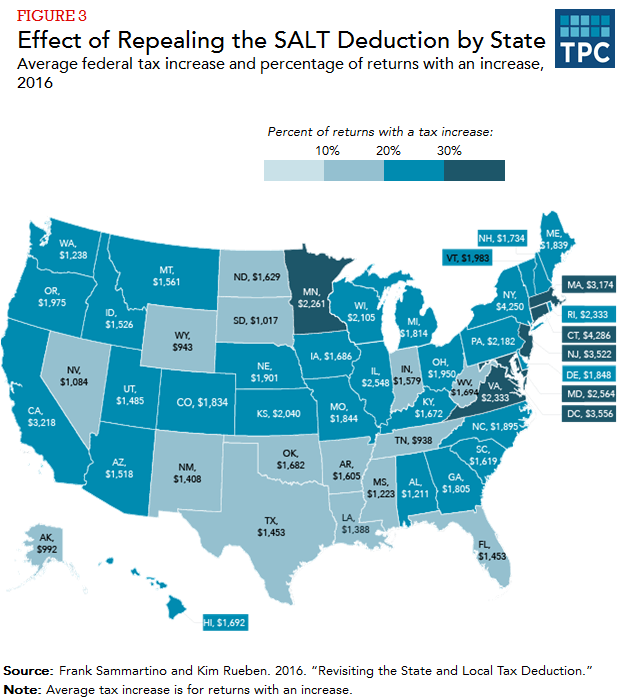

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less